Posted by The Coin Company on 6th Mar 2020

Silver performance in 2020: will it outperform gold?

The Coin Company would like to share a great blog post by the Perth Mint regarding current situation on silver market. Must read!

--------------------------------------------------------------------------------------------------------------------------------------------------

Precious metals are back on the investment radar in 2020, with the price of gold rising by over 12% in AUD terms and 4.5% in USD terms in the first two months of the year.

The strong performance continues a period of substantial price growth that dates back to Q4 2018, when a sharp decline in equity markets helped kickstart the rally in gold. Since then, the price of gold has increased by 48% in AUD terms and 33% in USD terms, with investment demand soaring.

Evidence of this can be seen in a Bloomberg news story from 26 February 2020, titled “Gold -Backed ETFs have never seen a run of inflows like this”, that highlights the fact that gold ETFs had seen net inflows for 25 days in a row, with total holdings at all-time highs.

Whilst it is true that gold has been a stellar performer of late, it is not the only precious metal achieving solid results. Silver has also delivered strong gains for investors, with the price rising by 29% in AUD terms and 16% in USD terms between Q4 2018 and the end of February 2020.

Crucially, just like gold, silver has substantially outperformed the broader commodities market over this time period. This is evidenced in the chart below, which plots the returns of gold, silver, oil and copper, as well as the ASX 200 from end September 2018 through to end February 2020.

Source: The Perth Mint, Market Index, London Metals Exchange, oilprice.com

The chart highlights the strong outperformance of gold and silver, with both rallying in Q4 2018, a period in which the ASX 200 and other commodities sold off. This demonstrates that both gold and silver have monetary safe haven qualities, unlike most commodities, which historically sell off during periods of equity market weakness and/or heightened concerns regarding the health of the global economy.

Strong demand for Perth Mint silver

The increase in the silver price has helped drive a notable increase in investment demand for Perth Mint products.

Since September 2018, sales of silver minted products have averaged almost 1 million ounces per month, which is a 28% increase relative to the average demand seen in the prior six years.

Demand for silver expected to rise

According to The Silver Institute update in early February 2020, “macroeconomic and geopolitical conditions will remain broadly supportive for precious metals, encouraging investors to stay net buyers of silver overall.”

Drilling down into certain sectors of the market, The Silver Institute expects:

• Holdings in silver exchange-traded products (ETPs) to remain elevated in 2020. Profit-taking in ETPs is likely to be limited, even with a price rally.

• Silver physical investment, which consists of purchases of silver bullion coins and bars, is forecast to increase for the third year in a row, up by around 7 percent in 2020.

Price wise, The Silver Institute is bullish with their forecast suggesting the USD silver price would average USD 18.40 this year, an increase of over 13% relative to last year. The expected price rise (much of which we’ve already seen in January and February) “is premised mainly on a positive spill-over from gains in gold, as the yellow metal will continue to benefit from macroeconomic and geopolitical uncertainties across critical economies. Concerns about the state of the global economy will have possible negative consequences for the industrial metals, and by extension, silver. However, the weight of institutional money flowing into a relatively small market should prove sufficient for silver to outperform gold.”[1]

Is silver set to outperform?

Whilst there are no guarantees that silver will outperform gold in 2020 and beyond, it is not uncommon for this to happen, especially in strong precious metal bull markets where the prices of both gold and silver rise.

As an example, between October 2008 and August 2011, the price of gold rose from USD 723 to USD 1823 per troy ounce, an increase of just over 150%. In that same time period, the price of silver rose from USD 9.81 to USD 41.47 per troy ounce, an increase of over 320%.

The gold to silver (GSR) ratio, which measures how many troy ounces of silver you need to buy for one troy ounce of gold, fell from 74 to 44 between October 2008 and August 2011, highlighting silver’s outperformance.

As at the end of February 2020, the GSR is sitting just above 95, with movements in this ratio from the end of 1999 through to today seen in the gold line on the chart below. The grey line represents the average GSR over time.

Source: The Perth Mint, Reuters

The chart makes it clear that the current GSR is the highest it has been in the past twenty years, indicating that over this time period, silver has never been this cheap relative to gold.

Assuming the gold price continued to trade at USD 1,600 per troy ounce (where it is at the time of writing), silver would need to rise to just under USD 25 per troy ounce for the GSR to revert to its average of the last 20 years, which is 65. That would be an almost 50% rally in the silver price, relative to where it is trading today.

For longer-term investors who can live with the greater price volatility that silver displays, the near all-time highs in the GSR are a notable development, highlighting the return potential that silver may offer in the years ahead.

------------------------------------------------------------------------------------------------------------------------------------------------------------

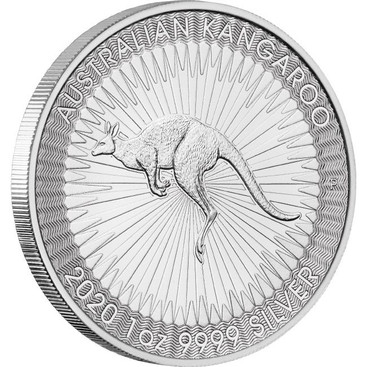

Did you know that you can buy Australian silver bullion coins through our E-store? Just click on bullion on website's main page or follow the link: https://thecoincompany.com.au/bullion/